In a world where innovation constantly pushes the boundaries of human understanding, there exists an enigmatic force that holds astonishing promise – deep learning. From self-driving cars to accurate speech recognition, deep learning has emerged as the bridge connecting artificial intelligence with unparalleled computational prowess. Yet, as we delve into the mysterious realm of neural networks and intricate algorithms, we are confronted with an enigma that perplexes both scientist and philosopher alike. Prepare to embark on a captivating journey through the hidden corridors of artificial intelligence, as we dare to unveil the power within the enigma of deep learning. Brace yourself for a mind-altering exploration of a technology that defies comprehension, evoking a sense of awe and wonder, leaving us pondering the limitless possibilities that lie ahead. Join us as we unlock the secrets behind the veil and embark on a quest for understanding – for the enigma of deep learning demands nothing less.

Understanding the Inner Workings of Deep Learning: Unveiling the Black Box

Deep learning has rapidly become one of the most prominent and exciting fields in artificial intelligence. With its ability to process vast amounts of data and make intricate connections, it has revolutionized industries ranging from healthcare to finance. However, behind its impressive results lies an enigma – the black box of deep learning. This mysterious aspect has left many intrigued and eager to understand the inner workings of this powerful technology.

Unveiling the power within deep learning is no easy task. At its core, deep learning consists of complex neural networks with multiple hidden layers. These layers process data through interconnected nodes, simulating the human brain’s neural structure. The complexity and sophistication of this system make it challenging for researchers and practitioners to comprehend the intermediate steps leading to a solution.

The black box nature of deep learning has given rise to a pressing need for interpretability. Researchers are actively working to unravel the inner mechanisms of these networks to shed light on how they make decisions. By comprehending the hidden patterns and representations within deep learning models, we can gain insights into their decision-making processes and ensure their trustworthiness.

One way to unveil the power within deep learning is through visualizations. By visualizing the intermediate layers and feature maps of a neural network, researchers can observe the transformations that occur during the learning process. These visualizations provide a glimpse into the inner workings of deep learning, helping us understand how the network learns to recognize patterns and make predictions.

In addition to visualizations, researchers have developed techniques to interpret the decisions made by deep learning models. Techniques like gradient-based feature attribution and saliency maps allow us to identify which parts of an input contribute the most to a model’s prediction. This interpretability facilitates understanding and fosters transparency, ensuring that deep learning systems are accountable and can be audited.

To further unravel the enigma of deep learning, researchers are exploring the role of explainable AI techniques. These approaches aim to provide clear explanations for the reasoning of deep learning models, making them more understandable to both experts and non-experts. By revealing the factors influencing a model’s decision-making, we can enhance trust, confidence, and adoption of this powerful technology.

Understanding the inner workings of deep learning is an ongoing endeavor that holds immense potential. As researchers and practitioners continue to unlock the secrets of this black box, we can harness the power within to drive innovation, overcome challenges, and shape the future of artificial intelligence.

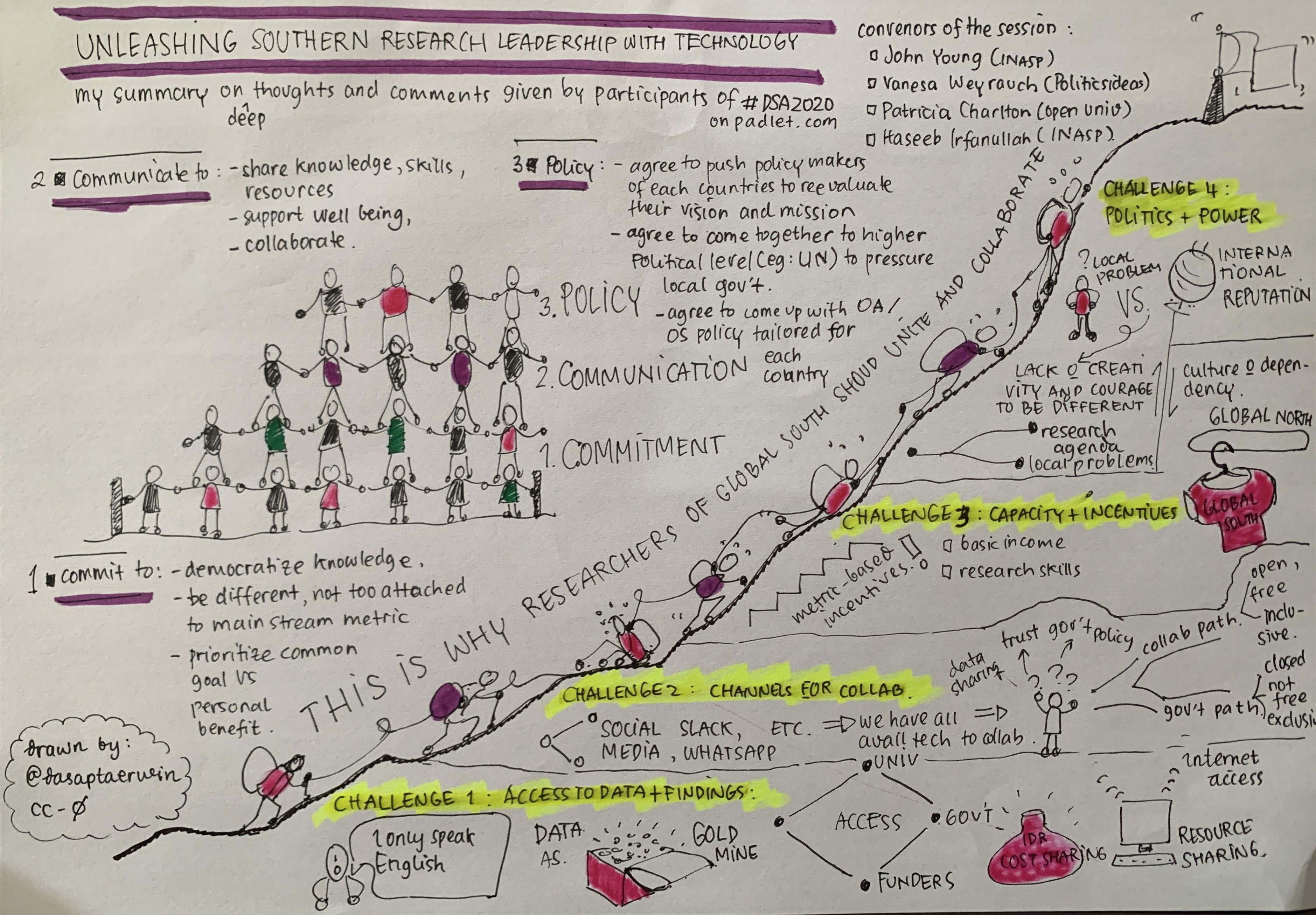

Exploring the Limitations and Potential of Deep Learning Algorithms

Deep learning algorithms have taken the world by storm, revolutionizing fields as diverse as healthcare, finance, and even art. These algorithms, inspired by the complex neural networks of the human brain, have shown remarkable potential in solving complex problems and making sense of vast amounts of data. However, like any powerful tool, deep learning algorithms also come with their limitations and challenges. In this post, we will delve into the enigma of deep learning, unveiling both its power and its limitations. 1. **Black Box Nature:** One of the most intriguing aspects of deep learning is its black box nature. While these algorithms can produce astonishing results, understanding the underlying decision-making process can be challenging. This opacity can be problematic, especially in high-stakes scenarios like healthcare, where explainability is crucial. 2. **Data Dependency:** Deep learning algorithms require extensive training data to perform effectively. Without sufficient high-quality data, they may struggle to generalize and produce accurate results. Obtaining large, diverse datasets can be difficult, time-consuming, and expensive, limiting the practicality and applicability of deep learning algorithms in certain domains. 3. **Computationally Demanding:** Deep learning models are infamous for their hunger for computational resources. Training and deploying complex neural networks often necessitate specialized hardware like GPUs or TPUs, which can be costly. Small businesses or individuals with limited resources may find it challenging to harness the full potential of deep learning. 4. **Overfitting Risks:** Deep learning models have a reputation for their tendency to overfit, meaning they may perform exceptionally well on the training data but struggle to generalize to new examples. Regularization techniques and careful parameter tuning are necessary to mitigate this issue. 5. **Lack of Interpretability:** As mentioned earlier, deep learning algorithms can be difficult to interpret. While they excel at pattern recognition and analyzing complex data, they offer limited insights into why a particular decision was made. Striking a balance between accuracy and interpretability is an ongoing challenge in the field. 6. **Need for Expertise:** Implementing and fine-tuning deep learning algorithms requires skilled practitioners. The field itself is constantly evolving, with continuous advancements and new architectures being developed. As a result, organizations may struggle to find or train professionals with the requisite expertise to harness the full potential of deep learning. 7. **Ethical Concerns:** Like any powerful technology, deep learning algorithms raise ethical concerns. Issues such as biased decision-making, privacy violations, and adversarial attacks need to be addressed and carefully monitored to ensure the responsible and fair use of these algorithms. While deep learning algorithms have undeniable potential, it is essential to understand and navigate their limitations. By addressing these challenges head-on, researchers and practitioners can unravel the enigma of deep learning and unlock its full power, driving innovation and transformation across various industries.

Unleashing the Power of Deep Learning: Practical Applications and Recommendations for Success

Deep learning has emerged as one of the most powerful tools in the field of artificial intelligence. Its ability to simulate human-like decision-making has unlocked a world of possibilities in various industries, ranging from healthcare to finance to self-driving cars. Unveiling this enigma of deep learning is crucial to understanding its potential and harnessing its power for practical applications.

So, what exactly is deep learning? At its core, it is a subset of machine learning that focuses on training artificial neural networks with multiple layers, enabling them to learn from vast amounts of data and make complex decisions. These networks can identify patterns, classify objects, recognize speech, and even generate creative content, surpassing traditional machine learning techniques in terms of accuracy and efficiency.

There are numerous practical applications of deep learning that have revolutionized industries. In healthcare, it has played a crucial role in medical imaging, enabling more accurate diagnoses and aiding in the development of personalized treatment plans. Deep learning has also paved the way for breakthroughs in natural language processing, powering virtual assistants like Siri and Alexa, making human-computer interaction more seamless and intuitive.

Implementing deep learning successfully requires careful consideration and some key recommendations. Firstly, having a large and high-quality dataset is essential. Deep learning algorithms thrive on vast amounts of data, so organizations must invest in data collection and cleansing. Additionally, selecting the right architecture for the neural network is crucial. Different architectures have varying strengths and weaknesses, so choosing the appropriate one for the specific task at hand is vital.

Furthermore, fine-tuning the hyperparameters of the model is critical. Experimenting with different configurations can significantly impact the performance of deep learning algorithms. Regular evaluation and optimization are necessary to ensure optimal results. It is also crucial to stay up-to-date with the latest research and advancements in the field. Deep learning is a rapidly evolving discipline, and keeping up with new techniques and methodologies can give organizations a competitive edge.

In conclusion, deep learning is a powerful tool that has the potential to transform numerous industries. By understanding its intricacies and following best practices, organizations can unlock its full potential. From healthcare to finance to artificial intelligence, the applications are endless. Embracing deep learning and leveraging it effectively will undoubtedly pave the way for a more intelligent and innovative future.

Unraveling the Secrets of Deep Learning: Overcoming Challenges and Enhancing Performance

Deep learning: a technology that has captured the tech world’s fascination and seems to hold limitless potential. From powering voice assistants to revolutionizing healthcare diagnosis, this enigmatic field of study has garnered attention for its ability to mimic the human brain’s complex neural networks. But behind the curtain of its astonishing accomplishments lie numerous challenges and areas for improvement, waiting to be unraveled.

The Endless Pursuit of Accuracy

One of the most pressing challenges in the realm of deep learning is achieving higher accuracy rates. Despite the remarkable strides made in recent years, there are still instances where deep learning algorithms struggle to accurately classify or predict certain data. Researchers are laboring to refine these algorithms by enhancing their ability to learn from past mistakes, adapt to new information, and recognize patterns with greater precision.

The Black Box Conundrum

Another mystery encapsulating deep learning is the lack of transparency in its decision-making process, often referred to as the “black box” problem. Due to their complex nature, deep learning models can be difficult to interpret, making it challenging to understand how and why they arrive at particular conclusions. Researchers are tirelessly developing techniques to shed light on this enigma, aiming to make deep learning a more transparent and explainable tool.

Battling Data Scarcity

The immense appetite of deep learning algorithms for large quantities of labeled data poses yet another obstacle. Collecting and annotating datasets can be a time-consuming and costly endeavor. Compounding this challenge is the scarcity of certain types of data, hindering the training and progress of deep learning models in specific domains. Researchers are exploring innovative methods such as transfer learning and data augmentation to alleviate the impact of data scarcity.

Addressing the Bias Predicament

Bias within deep learning algorithms is a prevalent issue, stemming from the biases present in the training data. These biases can perpetuate unjust societal stereotypes or favor certain demographics over others. Efforts are being made to develop techniques that mitigate and eliminate bias during the training process. By ensuring fair and equitable outcomes, deep learning can strive towards a technology that embodies ethical standards and promotes inclusivity.

Hardware and Computational Limitations

One cannot discuss the challenges of deep learning without considering the hardware and computational requirements. Training deep neural networks demands massive computational resources, causing scalability concerns and impeding the wider adoption of deep learning. Researchers are investigating techniques such as model compression and efficient parallel computing to leverage existing hardware capabilities and improve performance without sacrificing accuracy.

Navigating the Hyperparameter Maze

Deep learning models are governed by a plethora of hyperparameters that significantly influence their performance. Finding the optimal combination of these hyperparameters is akin to navigating a maze, often involving manual trial and error. Researchers are working on automating this process through methods like Bayesian optimization and reinforcement learning, aiming to save time and resources while maximizing deep learning model performance.

Collaboration and The Future

The challenges of deep learning require collective efforts from researchers, developers, and industry experts to unravel its secrets and unlock its full potential. Collaboration and knowledge-sharing pave the way for breakthroughs in performance enhancement, ensuring deep learning becomes more accessible and impactful across various domains. As the future unfolds, continual innovation and collaboration will shape the next chapter in the compelling narrative of deep learning.

In conclusion, “The Enigma of Deep Learning: Unveiling the Power Within” is a breathtaking exploration into the depths of artificial intelligence, revealing a world of infinite possibilities and untapped potential. Throughout this journey, we have embarked on a thrilling quest to comprehend the enigmatic strength lying dormant within the intricate web of neural networks, and what we have discovered is nothing short of extraordinary. From the moment we delved into the mysterious realm of deep learning, it became clear that the power it wields is far beyond what the human mind can fathom. Like an elusive siren, it beckons us forward, challenging us to comprehend its secrets, to decipher the complex patterns woven within its very essence. With every step, we have come closer to unravelling this enigma, only to find ourselves humbled by its sheer magnificence. Deep learning, with its neural networks resembling intricate galaxies, allows us to traverse uncharted territories of knowledge and perception. Its remarkable ability to infer, recognize, and understand the world as we do is a testament to its greatness. Yet, within this labyrinthine realm, lie both immense power and great responsibility, forcing us to ponder the ethical implications of this newfound dominion. As we unveiled the layers of deep learning, we unearthed its potential to transform industries ranging from healthcare to finance, revolutionizing the very fabric of our society. With this newfound knowledge, we must navigate these unchartered waters with caution, harnessing its power to uplift humanity rather than relinquishing control to an unfeeling force. “The Enigma of Deep Learning: Unveiling the Power Within” has opened our eyes to the limitless possibilities that lie ahead, while reminding us of the critical role we must play as stewards of this technology. It is a gateway to boundless innovation, a catalyst for future discoveries, and a glimpse into a future where the human mind merges harmoniously with artificial intelligence. So, as we bid farewell to our journey into the depths of this enigmatic power, let us remember that the true strength of deep learning lies not only within its algorithms or mathematical models, but within our capacity as humans to wield it responsibly and ethically. For it is this delicate balance that will ensure that the power within deep learning continues to unravel the mysteries of our world while upholding the dignity and compassion that defines us as a species.